Truth be told, I had no intention of getting myself registered as a freelancing “professional.” (if writers are considered as “professionals” which the BIR says they are) It’s not that I do not wish to cheat on taxes despite my apprehensions and frustrations with the way things are run in the government today. Rather, my non-intent is borne out of practical reasons. One of them being I am currently a full-time employee, so I’m already paying taxes through the withholding tax deducted from my payslip. The other one is the fact that my writing gig is a part-time thing at this point, (something I stress much often) not to mention it’s a gig I am still a noob at. As such, whatever I’m getting at the moment is not that much, some of them are not even paid writing gigs, but that’s another story.

But lately, I’ve encountered some challenges thanks to a directive by the Bureau of Internal Revenue (BIR) which requires professionals to be registered. Thus, some outfits I’ve been writing or wishing to write for are asking for official receipts from their contributing writers. Unfortunately, getting an official receipt for yourself involves getting yourself registered with the BIR. So, out of a desire to avoid possible issues in the future, I decided to have myself registered with the BIR as a professional, a part-time professional that is.

For quite a while, I’ve scoured the internet and elsewhere for whatever information I could find on being registered as a part-timer. However, most information I could find pertains only to full-timers. While I eventually found out that some of the details are basically the same, still it is frustrating that part-time freelancers like myself have not much reference to look up to, especially in the aspect of taxation.

Thus, in the tradition of the previous Urban Roamer guides, I’ve decided to put out this special entry as a “public service” of sorts for fellow professionals, especially the part-time ones like writers, who are considering or in the process of having themselves registered with the BIR. It is my hope that this would serve somehow as a handy reference that you would find useful. Enough of that as we detail the process after the break.

FIRST THINGS FIRST

Being registered as a professional means you have to be registered with the Revenue District Office (RDO) of the BIR where the place where you will be doing your profession is under. In the case of writers, many don’t have their own office space so it’s usually at the place of residence. Now if you’re employed, the default RDO is normally the one which your company’s address falls under. So if you are going to get yourself registered as part-time professional, you would first have to make a request first with your current RDO for a transfer to another RDO through the BIR Form 1905, unless the RDO of your home and work is the same. So if for instance you work in Makati but reside in Antipolo, you would have to request for a transfer from the RDO in Makati to the RDO of Antipolo. Wait for a week or two at least for this request to be processed.

THE REQUIREMENTS

Once the transfer is completed, you can begin with the registration process. Depending on your line of profession, the BIR has set up a list of requirements applicable to the profession you will be registering, so it’s better to get in touch with them as to what documents you may need to submit. In my case as a writer, the BIR required me to submit a copy of my birth certifcate, barangay clearance, and a certification of freelance work from any of the publications I’ve written for. I was not required to submit anything like a municipal permit, perhaps due to the nature of my freelance work.

GETTING REGISTERED

With the required documents in tow, you could now proceed with the registration process in which you would fill out Form 1901, the registration form for professionals, single business owners, as well as mixed income taxpayers. (which part-time freelancers fall under) You will submit the filled out form and the required documents to the BIR officer in charge of new registration who will proceed to have to review and validate your registration.

Once everything is completed, you will be asked to pay for the annual registration fee which is P500 with Form 0605, the form to be filled out for payment. And here’s where things get tricky. Recently, the BIR has been transitioning towards an online or electronic type of system. With such moves, the BIR is no longer printing some forms, including the income tax return forms and the Form 0605. So at this point, the BIR won’t be able to provide you the old form for you to fill out with pen and paper. Instead, at least in some cases like mine, you will be directed to someone (not sure if the person I transacted with is a BIR employee or some “enterprising” fellow) who will be printing your Form 0605 already filled out with your particulars including the payment figures. And, in my case at least, no it is not free as you would have pay for the printing which in my case was P30 for a single copy. Sigh…

As for the payment, you must pay at one of the accredited banks/payment centers specified by the BIR RDO you will be registered in so check with your RDO for the list of those accredited outlets. Chances are, the nearest center to the RDO would have a long queue of fellow taxpayers, more so if that center happens to be a Landbank branch.

Once you have paid the registration fee, you need to go back to the RDO and provide them a copy of the Form 0605 as well as the transaction slip of the payment you just made. You will then be advised to return after 2 days at least for the certificate of registration (COR) that will be provided to you.

FINALLY REGISTERED…SORT OF

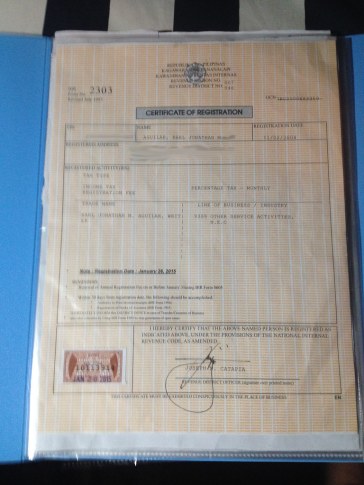

Upon your return to the RDO, you should be handed now your Certificate of Registration (COR) where you can find the particulars regarding your registration like the name of your business that would appear on record (which in my case was my name followed by “writer”) and the taxes you will be required to pay regularly. For professionals, full-time or part-time, these taxes would the annual registration fee, the income tax which you would have to pay not only every year but every 1st to 3rd quarter of the year, and the percentage tax which you would have to pay every month. You don’t have to worry about VAT if your gross revenue for a given month is not above P 1,919,500.00 (which I’m sure part-time freelancers do not get such revenues in the first place)

Also, you will receive this registration document that you can use to hang on your wall like what other establishments do.

But the process does not end there as your COR states you would need to provide the books of account and a copy of the official receipt you will be printing one month from the date of registration indicated in the COR. The books of account you would need to provide depends on your work; in my case as a writer, I was required to have a journal and a ledger which you can find at your neighborhood bookstore. The most challenging but very crucial in this part of the process is getting your official receipt printed.

TO BEING AN OFFICIAL RECEIPT-ISSUING (PART-TIME) PROFESSIONAL

You cannot consider yourself a duly-registered professional (full-time or part-time) without an official receipt under your name. After all, it is being able to issue an official receipt is why we bother getting ourselves registered in the first place. Thus it is very important that the printer of your official receipt is someone accredited by the BIR. You cannot just approach any neighborhood printer that you know, you must get in touch with your RDO to know which printers in your area are BIR-accredited or you can check this list of BIR’s accredited printers online, complete with contact information too.

Once you have a printer, you will be asked by your printer to provide a copy of the COR and the Form 0605 that reflected your registration payment. Other than that, the printer will take care of printing your official receipts and have them stamped by the BIR. One thing to note though is that there is a minimum number of official receipts to be printed as mandated by the BIR and that minimum is 10 booklets of 50 receipts each booklet. And no, even if you don’t see yourself consuming 500 pages within a five-year period, (which is the length of time for you to use those printed official receipts) you cannot be able to request printing less than that required number.

As mentioned earlier, on your end, you would be the one to process the registration of the books of account. The good thing about it is that you do not have to go every year or some regular period to have the books updated. Once your new books of account are registered, all you need to bother with on your end is to fill out the details until the last page is consumed no matter how long it took to consume all those pages. The only time you need to go to the BIR is to have your new books of account registered with them, in such case you just fill out the Form 1905, the same form you filled out if/when you transfer to another RDO which was discussed earlier.

FILING TAXES, THE “EXCITING” PART OF IT ALL

Once you have completed those steps, then congratulations! You are now a duly-registered professional, even if in part-time capacity. And along with such a new distinction, you can not only enjoy now the privilege of issuing official receipts under your name. You also get to partake in the exciting task of filing your taxes regularly…on your own.

As detailed in the COR, in the case of a number of professionals including part-time ones like myself, you need to pay 2 types of taxes: the percentage tax which you need to pay monthly and the income tax which you pay every 1st to 3rd quarter and every year as well. The computation for these taxes deserve a separate entry for more in-depth discussion. But even if you do not have any income from your part-time work in a given month/quarter, you are still required to file the percentage and income tax returns respectively. You just put in the zeros and file them at your RDO as non-payment.

As in the case of the Form 0605, the forms in filing the percentage and income tax returns (Forms 2551M for the percentage tax return and 1701Q for the quarterly income tax, 1701 for the annual income tax return) are now only available online. If you do not wish to be bothered having them printed and pay extra, you can fill out and download the forms directly from the BIR website at the eBIRForms page. You just need to download the .exe file that will generate whatever BIR form you need and it will take care of the computation too. So you just need to fill out the needed information and print them out.

POSTSCRIPT

As a newly-registered professional, you are required also to attend the seminar for new taxpayers being held regularly by the RDO. Even if it’s not required, I highly advise you attend one of these seminars to give you a better understanding on how taxation for professionals like yourself work. It is an opportunity too to get in touch with someone from the BIR to answer whatever questions you may have. Check with your RDO for the schedule of these seminars and take advantage of them. They are being held free of charge so no worries there.

=============

I hope this lengthy post be of help as you go through the BIR registration process. If you have any questions with regards to this entry, I will try to answer them as best as I can. The key word there is try as I am no taxation expert. As such, any further information that can be shared with regards to this matter is highly appreciated.

Let us all strive to be responsible taxpaying citizens as we hope for a better taxation system for all of us.

4 Comments

Shayne

Thank you for creating this entry, Karl! Matagal ko nang iniintay gawin mo ito. hihi. salamat!!!

Steph

Gratitude for putting this together!

Jade

Awesome post, thanks!

Joy

Hi, i also registered as a professional. How do you fill out your ledger and journal? I’m quite confused. Which one is for the cash receipts and which one is for the cash disbursement? Thanks.